How to Optimize Your Taxes: A Comprehensive Guide for Residents and Non-Permanent Residents in Luxembourg ...

460 Luxembourg Companies Potentially Affected by New U.S. Tariffs ...

Luxembourg Drone Center Officially Launched to Meet Soaring Demand in Civilian UAV Sector ...

Luxembourg Authorities Issue Warning Over Surge in Counterfeit Tobacco and Alcohol Products | 40 Tons of Illegal Tobacco Seized in Eschweiler ...

New Campaign Launched to Promote Road Respect and Safety Across Luxembourg ...

Is the EU on the Verge of Overhauling Vehicle Inspection Standards? ...

Asylum Processing Times in Luxembourg Continue to Rise Despite Government Pledges ...

Official Details Announced for Luxembourg's Royal Transition: Prince Guillaume to Be Sworn in as Grand Duke on October 3, 2025 ...

How to Optimize Your Taxes: A Comprehensive Guide for Residents and Non-Permanent Residents in Luxembourg

Luxembourg – May 6, 2025

As the tax season begins in Luxembourg, official forms for filing income tax returns are now available to the public. This period often raises essential questions for many taxpayers: Am I required to file a tax return? Which expenses are tax-deductible? Who can assist me in this process?

Who is Required to File a Tax Return?

According to Luxembourg tax regulations, the obligation to file a tax return depends on residency status and total taxable income. Filing is mandatory under the following conditions:

If your taxable income exceeds €100,000;

If you have multiple income sources (such as salaries or pensions) exceeding €36,000 for tax classes 1 and 2, or €30,000 for class 1A;

If you are a non-resident and a global tax rate has been applied to your tax card;

If your taxable income exceeds €11,265 and includes more than €600 in income not subject to withholding tax in Luxembourg;

If you earn over €1,500 in investment income (e.g., dividends) subject to capital income tax;

If you earn over €1,500 in net income from directors' fees (tantièmes);

If the Administration des Contributions Directes has explicitly required you to file a return;

If you are married, and one spouse is a resident while the other is a non-resident, and you have opted for joint taxation.

Additionally, taxpayers in classes 1 and 1A can file a voluntary tax return to declare deductible expenses and potentially receive a refund. In such cases, they must declare all domestic and foreign income.

What Expenses Are Tax-Deductible?

Several types of expenses can legally be deducted from taxable income. The most common deductible items include:

Employment-related expenses (Frais d’obtention);

Alimony or pension payments to a former spouse;

Mandatory social security contributions;

Personal insurance premiums;

Payments into voluntary pension schemes;

Contributions to home savings plans;

Payments into supplementary pension schemes, donations, or charitable contributions;

Household service costs and childcare expenses.

When is the Deadline?

The final deadline to submit a completed tax return is December 31 of the current year. This applies to both mandatory and voluntary filers. The LCGB trade union recommends filing as early as possible to ensure timely processing and potential refunds.

Where to Get Help

The LCGB provides advisory services to help individuals choose the most suitable tax options based on their personal circumstances. Union members who have been affiliated for more than six months are eligible for free assistance in completing their tax return.

To make the most of tax deductions and avoid delays, individuals are encouraged to keep their annual financial records, salary slips, insurance contracts, pension contributions, and receipts related to childcare and housing expenses well organized and up to date.

460 Luxembourg Companies Potentially Affected by New U.S. Tariffs

Luxembourg – May 6, 2025

Following the introduction of new import tariffs by the United States, approximately 460 companies based in Luxembourg may be directly impacted by the new trade measures. Among them, 41 firms operating in the transport equipment sector are particularly exposed to the risk of increased duties.

The issue was raised in response to a parliamentary question by Sven Clement, a member of the Pirate Party (Piratepartei), who requested clarity on the economic implications of the latest U.S. tariff decisions under the administration of Donald Trump.

Uncertain but Concerning Impacts

In a joint reply, Lex Delles, Minister of the Economy, Xavier Bettel, Minister of Foreign and European Affairs and Foreign Trade, and Gilles Roth, Minister of Finance, emphasized that a precise assessment of the impact is currently not possible, due to the number and complexity of variables involved. However, they confirmed that Luxembourg’s official statistics and economic analysis body, STATEC, is actively developing a model to measure the potential economic effects of these tariffs.

Among the critical factors being considered is the exchange rate of the U.S. dollar, which plays a significant role in determining the level of economic pressure on Luxembourgish exporters.

Risks to the Financial Sector and the EU Response

Luxembourg authorities have expressed concern that, if the tariffs are implemented as promised by the Trump administration, they could result in "unprecedented" and "historic" increases. Such developments could have serious implications for global financial markets and potentially expose Luxembourg’s financial services sector to revenue losses.

Support for a Coordinated European Approach

In their joint statement, the three ministers affirmed that “the Luxembourg government supports a unified European response and ongoing dialogue with the United States to avoid a tariff escalation.” Should diplomatic efforts fail, Luxembourg will endorse a proportionate countermeasure by the European Union in response to U.S. trade actions.

These developments come as analysts and policymakers worldwide closely monitor the economic direction of the Trump administration’s first 100 days, which have already signaled a shift toward broader international trade tensions.

Luxembourg Drone Center Officially Launched to Meet Soaring Demand in Civilian UAV Sector

Luxembourg – May 6, 2025

Luxembourg’s Minister of Education and Youth, Claude Meisch, has officially inaugurated the Luxembourg Drone Center, a state-of-the-art facility dedicated to training, experimentation, and innovation in the field of civilian drones. The center, which operates under the umbrella of the Centre national de formation professionnelle continue (CNFPC), is positioned as a direct response to the rapid growth of the drone industry and the increasing diversification of its professional applications both nationally and internationally.

Surge in Drone Usage Spurs Training Demand

According to the Direction de l’Aviation Civile (DAC), Luxembourg had 4,144 registered drone operators as of March 13, 2025—an 85% increase compared to two years ago. This exponential growth has amplified the urgent need for specialized training, especially since new EU regulations introduced in 2021 require mandatory certification based on the category of drone operation.

Prior to the launch of this new center, the only recognized drone training programs were offered by the DAC in cooperation with the Eurocontrol Aviation Learning Center.

Enhancing Luxembourg’s Drone Education Infrastructure

The Luxembourg Drone Center offers certified training programs that complement the existing educational framework and eliminate the need for local drone operators to seek certification abroad. These training programs address a wide range of professional drone applications including infrastructure inspections (bridges, wind turbines, power lines), mapping and topography, audiovisual production, precision agriculture, industrial cleaning (e.g., façades and solar panels), and the management, storage, and protection of collected data.

The courses are designed to cater to all levels of experience—from beginners to seasoned professionals—whether in the public sector, private enterprise, commercial industry, or scientific research. Experienced operators can enhance their technical and practical expertise, while newcomers gain the essential knowledge for professional drone use. The center also opens new avenues for professional reintegration and upskilling in a future-driven job market.

All programs are conducted under the supervision of instructors who specialize in drone operation, aviation safety, regulatory compliance, and equipment maintenance.

The Luxembourg Drone Center marks a strategic move to align national workforce development with the evolving needs of the job market, while also fostering innovation and opportunity in one of today’s most dynamic and fast-growing technological sectors.

هLuxembourg Authorities Issue Warning Over Surge in Counterfeit Tobacco and Alcohol Products | 40 Tons of Illegal Tobacco Seized in Eschweiler

Luxembourg – May 6, 2025

Luxembourg’s Customs and Excise Administration (Douanes et Accises) has conducted a series of high-profile operations across the country in recent days to crack down on the sale and storage of illegal tobacco and alcoholic products. These coordinated efforts, which included inspections of retail shops in the capital and a major warehouse raid in the north, resulted in the seizure of a substantial quantity of counterfeit goods.

Urban Inspections Reveal Illegal Sales

On April 18, 2025, customs officers, in collaboration with regulatory agencies, inspected three retail stores in Luxembourg City suspected of selling unauthorized tobacco, nicotine products, and alcoholic beverages.

In one store, authorities uncovered violations related to excise tax regulations and operating without a valid license. The following products were seized during the operations:

Over 90 liters of e-cigarette liquid

6 kilograms of nicotine pouches

5 kilograms of chewing tobacco

1 kilogram of shisha tobacco

100 grams of snuff tobacco

37 liters of premixed alcoholic beverages

These infractions led to fines totaling €12,897.

The Customs Administration reiterated that selling products containing nicotine or alcohol is strictly prohibited without official authorization. Violators risk immediate confiscation of goods and significant financial penalties. Authorities also warned that consumption of counterfeit alcohol, in particular, poses serious health risks to consumers.

Massive Tobacco Seizure in Eschweiler Warehouse

Continuing their enforcement campaign, special customs and police units carried out a large-scale raid during the night from Wednesday to Thursday in Steil Street, located in Eschweiler, near Wiltz in northern Luxembourg. Witnesses reported that armed and masked officers stormed the site, causing suspects to flee into the nearby forest.

During the operation, officials discovered and confiscated an estimated 40 tons of illegal tobacco. Although the customs office has not officially confirmed the exact quantity, three cargo trucks were required to transport the goods. Police and customs officers remained on site through the end of the week.

Local residents had previously reported suspicious activity around the warehouse, including unusual nighttime traffic and the presence of unknown individuals. Witness accounts also indicated that the tobacco was stored in large-scale packaging, pointing to a potential commercial distribution operation.

A Firm Stance Against Smuggling and Public Health Risks

These actions highlight Luxembourg’s firm commitment to combatting the illegal trade of tobacco and alcohol. Public health experts have also raised concerns about the dangers of consuming unregulated products, which can pose serious threats to consumer well-being.

The Customs and Excise Administration has called on the public to report any suspicious activity or unauthorized sales to the relevant authorities to help protect both public health and the nation’s economic integrity.

New Campaign Launched to Promote Road Respect and Safety Across Luxembourg

Luxembourg – May 6, 2025

Luxembourg’s Minister for Mobility and Public Works, Yuriko Backes, has launched a new nationwide campaign aimed at fostering a culture of mutual respect on the roads and reducing traffic accidents. Titled "The Road Is for Everyone, So Are the Rules", the campaign is being rolled out in collaboration with ProVelo.lu, the Sécurité Routière, and the Grand Ducal Police.

A Safer Road for All Users

The initiative is designed to remind all road users of the importance of complying with traffic regulations. Unlike many past efforts, this campaign intentionally avoids singling out any specific group of users as responsible for road hazards. Speaking at the launch, Minister Backes highlighted the need for shared responsibility:

“Some road users, such as cyclists or pedestrians, are more vulnerable because they are more exposed. Others, who drive larger vehicles, may be less so. What matters is coexistence, mutual respect, and adherence to traffic rules.”

Despite a decline in fatal road accidents in Luxembourg, statistics indicate an increase in non-fatal injuries, particularly among vulnerable users, including cyclists and motorcyclists.

Raising Awareness Through Visual Messaging

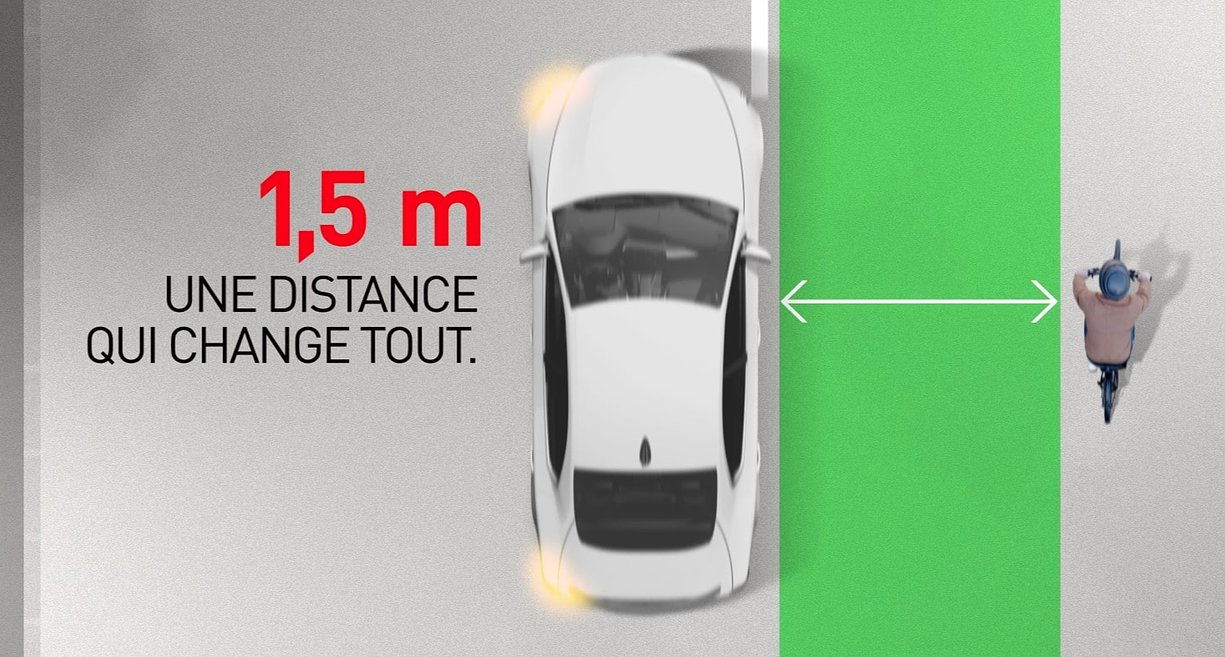

To promote broader awareness, the campaign features a series of posters and videos illustrating four real-world traffic situations that present particular danger, such as the blind spot risk faced by cyclists when interacting with larger vehicles.

A key message throughout the campaign is the importance of maintaining a 1.5-meter distance between vehicles and cyclists, reinforcing not only the legal requirement but also the shared responsibility for safety.

Shared Responsibility Over Blame

Isabelle Medinger, Director of Sécurité Routière, emphasized the collective nature of the problem and dismissed the notion that cyclists alone are to blame:

“There is a growing perception in society that cyclists often ignore traffic laws. However, we at Sécurité Routière stress that responsibility does not lie solely with cyclists. Motorists and drivers of larger vehicles, who pose a greater potential risk, also have an essential role to play. As the campaign rightly states, the road belongs to everyone, and so do the rules.”

A Clear Message for All Road Users

This latest campaign by the Ministry of Mobility and Public Works is more than a public reminder—it is a firm call for equality in responsibility on the roads. With all users expected to follow the same rules, the campaign seeks to cultivate a more respectful and safer environment for everyone navigating Luxembourg’s streets.

Is the EU on the Verge of Overhauling Vehicle Inspection Standards?

Luxembourg – May 6, 2025

The European Commission has recently unveiled a proposal aimed at harmonizing vehicle inspection rules across member states to enhance road safety. While the initiative has sparked concern and criticism in neighboring countries such as Germany, the proposed changes are unlikely to bring significant disruption in Luxembourg, where similar standards are already largely in place.

Annual Inspections for Older Vehicles

At the heart of the Commission’s proposal is the introduction of mandatory annual technical inspections for passenger cars and light vans over ten years old. The EU estimates that such a measure could reduce traffic fatalities and injuries by 1% annually, contributing to the broader objective of halving road deaths by 2030.

Additional elements of the proposal include the compulsory registration of mileage in national databases, the implementation of new tests for electronic safety systems, and stricter emissions control procedures.

Luxembourg Already Ahead of the Curve

Unlike countries such as France or Germany, where the proposed measures would require considerable adjustments, Luxembourg’s existing framework closely aligns with the Commission’s vision. The Automobile Club of Luxembourg (ACL) noted that many of the requirements outlined in the proposal are already in force or scheduled for imminent implementation.

According to the current national system:

First technical inspection occurs four years after initial vehicle registration

Second inspection follows two years later

From the sixth year onward, inspections become annual

Bob Manet, Chief Operating Officer of the Société Nationale de Contrôle Technique (SNCT), emphasized that these regular checks ensure vehicles remain in proper technical condition.

Digital Systems and Mileage Monitoring

Since October 2023, Luxembourg has been collecting mileage data from newer vehicles (M1 and N1 categories, produced since 2021) via onboard diagnostics (OBD) interfaces. These readings are compiled by inspection centers and transmitted to the European Commission for assessing actual CO₂ emissions by country.

The SNCT has also announced plans to soon begin software-based testing of digital safety systems, such as the eCall emergency response system, to verify their operational integrity. These initiatives are part of broader efforts to improve road safety and enhance environmental transparency in road transport.

Varied Standards Across Europe

While countries like Spain, Austria, Portugal, and Ireland have long required annual inspections for older vehicles, France and Germany continue to operate on a biennial inspection cycle following the initial check. The German automobile club (ADAC) has criticized the EU proposal, arguing that annual inspections for ten-year-old cars are neither necessary nor efficient. Politicians from the CSU and AfD parties have echoed these concerns, citing increased costs and bureaucratic burden for vehicle owners.

On the other hand, in countries where annual inspections are already in place, the cost of inspections tends to be lower than Germany’s biennial TÜV system, although the scope of services may vary.

Legislative Process Still Underway

Before the European Commission’s proposal can become binding legislation, it must receive approval from both the European Parliament and the Council of the European Union. Until then, member states retain the right to tailor the implementation of such measures according to their national contexts.

Asylum Processing Times in Luxembourg Continue to Rise Despite Government Pledges

Luxembourg – May 6, 2025

Despite repeated promises from the government to speed up the asylum application process, official data reveals a consistent increase in processing times in Luxembourg—a trend that has now been acknowledged by Minister of the Interior Léon Gloden.

In a written response published Friday to a parliamentary question from Paulette Lenert, a member of the Socialist Workers’ Party (LSAP), Gloden admitted that the administration has not yet achieved its stated goal of accelerating asylum procedures, despite ongoing efforts.

From 10 to 13 Months: Delays Continue to Mount

According to figures released by the Ministry, the average time to process an asylum application in 2022 was 10.3 months. That figure has climbed to 13.6 months in the first few months of 2025. Gloden attributes part of the delay to the complexity of European regulations, particularly the Dublin III Regulation, which requires authorities to determine which EU country is responsible for handling each application—a process that often prolongs decision times.

The Impact of Global Crises

The Minister also cited international instability as a key driver behind the increased caseload. Specific reference was made to the Taliban’s return to power in Afghanistan (2021), Russia’s invasion of Ukraine (2022), ongoing conflicts in the Middle East, and the collapse of Bashar al-Assad’s regime in Syria. These events have collectively led to a surge in asylum requests across Europe, including Luxembourg.

As of March 31, 2025, a total of 2,081 individuals were awaiting interviews with immigration authorities. This figure includes minors, applicants no longer under Luxembourg’s jurisdiction, and those who have since withdrawn their applications.

Individual Case Review Remains a Priority

Despite mounting pressure to streamline the process, Gloden emphasized the importance of maintaining the quality and thoroughness of assessments. “Each asylum application is evaluated individually and carefully,” the Minister stated, adding that no nationality is given preferential treatment, and date of application remains the primary consideration.

Starting in June 2025, a new digital platform will be launched to support case management, with the aim of improving efficiency. Parallel initiatives are already underway to recruit additional staff and enhance training within the immigration services. However, Gloden cautioned that speed should not come at the expense of sound judgment.

Algerians Lead in 2025 Asylum Applications

According to the latest government statistics:

In 2024, a total of 2,018 asylum applications were submitted, with 762 individuals granted refugee status.

In the first two months of 2025, 356 new applications were recorded, and 66 applicants were granted asylum.

So far in 2025, the highest number of applications have come from nationals of:

Algeria: 14.3%

Syria: 13.2%

Eritrea: 11.2%

Colombia: 7.9%

Morocco: 7%

In light of these figures and ongoing global instability, Luxembourg’s asylum system faces a difficult challenge in striking a balance between efficiency, accuracy, and fairness—a challenge that may require substantial structural reforms and technological support to overcome.

Official Details Announced for Luxembourg's Royal Transition: Prince Guillaume to Be Sworn in as Grand Duke on October 3, 2025

Luxembourg – May 6, 2025

As Luxembourg prepares for a historic transition within its royal family, the government and the Maison du Grand-Duc have officially released the schedule for the abdication ceremony and the accompanying public celebrations. Prince Guillaume, the current Hereditary Grand Duke and Lieutenant Representative, will formally assume the title of Grand Duke of Luxembourg on Friday, October 3, 2025, succeeding his father, Grand Duke Henri.

Friday, October 3: Abdication and Oath of Office

According to the official announcement, the transition will begin with the signing of the abdication act by Grand Duke Henri at the Grand Ducal Palace. Following the abdication, Prince Guillaume will take the constitutional oath of allegiance before the Chambre des Députés (Luxembourg’s Chamber of Deputies), officially becoming Grand Duke.

The Grand Ducal Family will then appear on the balcony of the Grand Ducal Palace and in Place Guillaume II, where the public will have the opportunity to witness the moment.

Later that day, a reception will be hosted at Cercle Cité, attended by government officials, institutional representatives, and members of the diplomatic corps. In the evening, a formal gala dinner will take place at the Grand Ducal Palace.

Saturday, October 4: Nationwide Festivities

The following day will be dedicated to public celebrations across the country. Dubbed the “National Day of Joy,” various events will be held in key cities and symbolic locations throughout Luxembourg.

In a symbolic royal tour, Grand Duke Guillaume and Grand Duchess Stéphanie will participate in popular celebrations in Wiltz, Dudelange, and Luxembourg City, with additional stops scheduled in Grevenmacher and Steinfort, giving citizens across the nation the chance to greet the new Grand Duke in person.

At 8:00 PM, the royal couple will arrive in the capital via the Pont Rouge. The day’s events will culminate with a drone light show and a special concert at Glacis Square, showcasing performances by leading Luxembourgish artists.

Sunday, October 5: Religious Ceremony at the Cathedral

The official celebrations will conclude on Sunday, October 5, with the Grand Ducal Family attending a Te Deum service at the Cathedral of Notre-Dame of Luxembourg. This traditional religious ceremony will serve as a moment of thanksgiving and mark the spiritual beginning of Guillaume’s reign as Grand Duke.

Further Details to Follow

The Maison du Grand-Duc has stated that the full programme of events will be published later this year. With its symbolic and historic significance, Luxembourg is preparing for a momentous occasion in its contemporary royal history.